Are we aware of how much it really costs to run a home in the UK? Recently Zoopla published a survey stating that the average renter is drastically unaware of how much they are paying on rent and utilities bills. The study found renters believe they are paying £1,227 per month on rent and utility bills, while in reality the national average is £1,819. This difference indicates that renters believe their rent and utilities are 30% cheaper than they actually are.

With rent prices rising proportionately faster than salaries across the UK, knowing how to budget for your living expenses is an increasing concern for many of today’s young renters. With this in mind, here at acasa HQ, we were curious about how aware our users were of the cost of running their homes so we ran an investigation.

First, in order to know how accurately our users could predict their living expenses, we needed to determine just how expensive is a Splittable household in the UK. Looking at thousands of pieces of data we found that the average Splittable household has three people and spends £1920 a month on their rent and running costs.

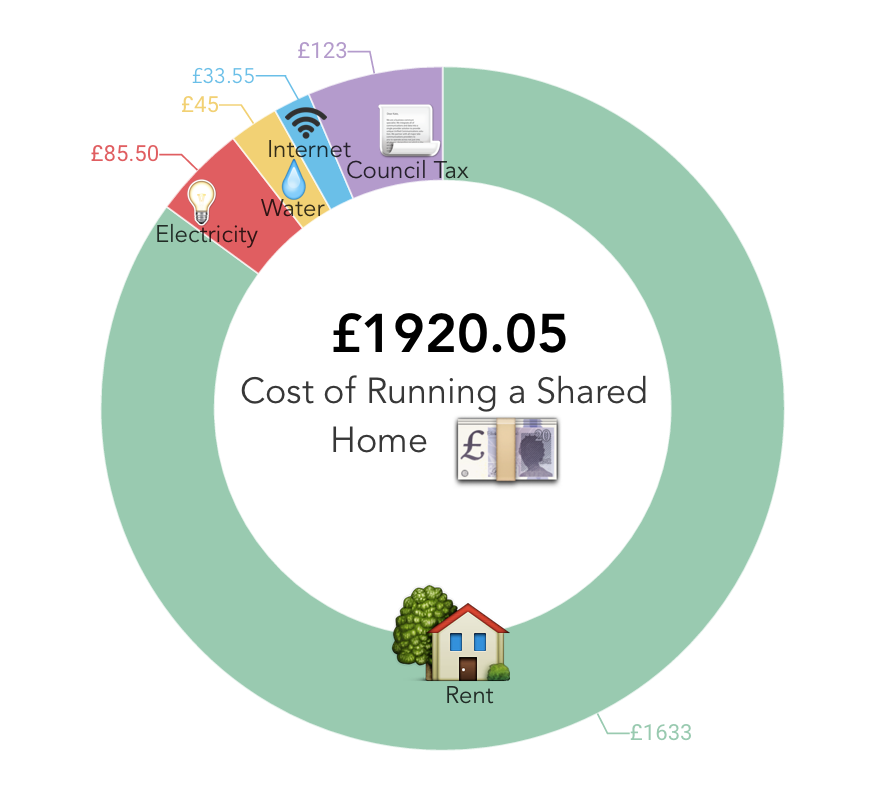

These costs break down to an average spend of £1633 for rent per month and £287 spent on other ‘running the home’ expenses per month. Council tax is the largest cost after rent each month accounting for 6.4% of monthly spending. The exact breakdown of expenses for a household per month can be seen in the figure below:

After determining the true cost of running a Splittable home each month, we wanted to determine how well our users were able to estimate their household running costs on top of the rent. We were thrilled to discover that our users could estimate their running costs within 5% of the true cost. Overall, users estimated a monthly spending of £99 on top of rent per person – just £3 more than our calculated average of a cost of £96 per month per person.

So how is it that Splittable renters can estimate their household running expenses within 5% while the average person in the UK underestimates by 30%? Our theory is that since Splittable enables its users to both track and split their living expenses with each other, users have an increased awareness of how much they are spending every month as opposed to someone who has an automatically enabled direct debit. This leads to our next question – does this increased awareness of household running costs result in savings?

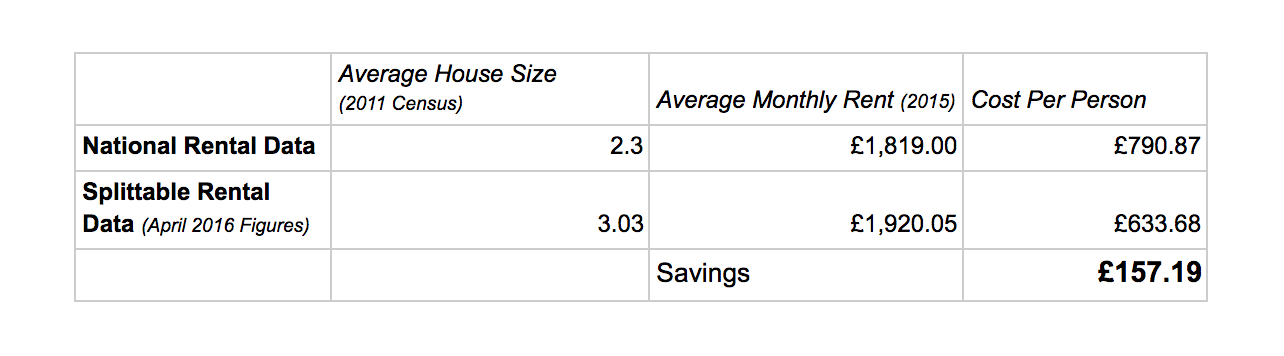

Comparing our renters to the national rental data, renters who use Splittable in the UK were able to save £157.19 per person. Here is a look at the data:

According to this data a Splittable user is able to save £157 per month compared to the typical renter. These savings could be due to the fact that expenses in a Splittable home are shared with more people than the average UK rented property. It could also be caused because Splittable users are more aware of what their household running costs are than the average consumer. Our users are consciously looking at how costs are split and seeing exactly what they’re spending. This awareness is what we believe is crucial to saving money.

Some other fun facts we discovered about our users spending:

Across our user base, households spent proportionately more on their utility bills between January – April than they did the rest of the year. You are not alone if your housemates or partner scolded you for the giant winter utility bills.

With Sky Broadband and Virgin Media as the most popular internet providers, of Splittable households, less than 50% pay for television on top of Internet. Of those paying, 25% of households opted for a Netflix subscription over the traditional TV License. These households saw a monthly savings of £5 with the Netflix subscription costing £6.99pm versus the £12 TV License. Really want to save money? It pays to Netflix and Chill 😉

Want to see if Splittable will help you save money on your household running expenses? Download it here.