It doesn’t matter if you are moving to London or you’re already on your 10th flatshare – finding a place to rent in London SUCKS! While there are numerous flats or houses for rent in the city, finding one that doesn’t break the bank can feel nearly impossible. Whether you are navigating all the houses for rent on the market or just need a spare bedroom, it’s a confusing landscape and is difficult to know where to start.

Here at acasa we want to help make the process a little less bad than it is for soooooo many Londoners and future Londoners. We’ve taken an in depth look at London’s rental market and this is what we’ve found.

What the F*** is really going on in the London Rental Market?

It’s expensive and it’s stressful!

- Housing is considered the biggest issue facing Londoners.

- There needs to be 50k homes built a year just to prevent the problem from getting worse. Only 24,230 were built in 2015 with less than ⅓ affordable.

- There needs to be 50k homes built a year just to prevent the problem from getting worse. Only 24,230 were built in 2015 with less than ⅓ affordable.

-

- The average rent for a 2 bedroom flat is £1,400.

- That’s worth 360 pints of beer…

- That’s worth 360 pints of beer…

- The average rent for a 2 bedroom flat is £1,400.

-

- London’s economy has been growing at 2x the rate of Britain and it’s population 50% faster. However distribution of wealth has been becoming less equal.

- London’s economy has been growing at 2x the rate of Britain and it’s population 50% faster. However distribution of wealth has been becoming less equal.

-

- It has become so difficult to get mortgages that the Bank of Mum and Dad (BOMAD) has become a top 10 mortgage provider.

-

- In 2015, BOMAD provided £5 billion in loans widening the wealth gap even more. Don’t underestimate the importance of FaceTiming with the parents.

-

- It has become so difficult to get mortgages that the Bank of Mum and Dad (BOMAD) has become a top 10 mortgage provider.

-

- Renting has become the norm and many have no hope of ever buying with the average price of purchasing a home in London over £500k.

- That’s how millennials got nicknamed, Generation Rent.

- Renting has become the norm and many have no hope of ever buying with the average price of purchasing a home in London over £500k.

Source: The Independent

What happened? Where are all the good flats and houses for rent?

The odds have not been in favour of young renters…

In fact, in many ways the odds have been increasingly stacking up against the millions of millennials living in London. In fact, in the last 20 years we have seen more young Londoners living with their parents, legislation that hasn’t emphasised the construction of affordable housing and a rise in population that the city’s infrastructure has not been able to support. Here you can take a look at all the ways life in London has changed for young professionals in the last 20 years.

Living with parents & the fight for the quality flats

“Currently 25% of 20-34 year olds live with their parents up from 17% in the mid 1990’s.” A report conducted by KPMG and the housing charity Shelter showed that this could increase to half of all 20-34 year olds by 2040. For those who are not lucky enough to have parents living close to the city, the situation can be dire.

They become forced into a Hunger Games-esque fight to get one of the few reasonably priced flats and houses for rent. Want a room for under £600 in zone 1 or 2? Better be ready for the claws to come out.

Legislation hasn’t been helping.

Previous legislation led by the former Mayor of London, Boris Johnson led to artificially high land prices. As developers were not required to build affordable housing, they were often overpaying for land since they knew they could drive higher profits.

The recently elected Sadiq Khan, has made big promises to fix the housing crisis. He has promised to demand 50% of homes built on new developments will be genuinely affordable. We’re pretty pumped about this at acasa – we’d love to work together with Khan in achieving that mission. Disclosure: acasa previously received funding from the Mayor of London’s investment fund, London Co-Investment Fund because of our focus on improving young renters lives.

What does it mean to increase affordable housing?

Affordable housing is defined by the government as:

“social rented, affordable rented and intermediate housing provided to specified eligible households whose needs are not met by the market.”

This type of housing will be available to those whose gross household income is between £18,000 to £66,000. Khan has also promised to increase the number of new houses being built in London which should help the amount of available flats and houses for rent. Construction of new homes has been at historic lows for the last 20 years. In this same time span though, the cost of a hectare of residential land (that’s about the size of 1 rugby pitch) has increased by over 300%.

Another policy change led by George Osborne – deemed the ‘landlord tax’ – has also has a negative effect on London property prices. The market was artificially stimulated as many sought to purchase before the policy’s April 1st implementation. In March alone, property prices jumped £30,000 leading to historic highs. Yes, that’s right – in one month, the cost of housing in London went up higher than most renter’s annual salary!

The tax calls for a 3% surcharge on buy-to-let and second home prices. The intention was to deter property investors and leave more property free for young families but turned into a massive blunder. Unfortunately it has already led to negative implications as this extra tax burden can be passed down from landlords to their tenants. Because many of the homes we rent are second homes for landlords, they can just pass this tax straight on to us.

Waves of urban migration are crashing into our world’s greatest cities leading to overcrowding.

There’s been a generational shift of people choosing to live in urban settings and London needs to learn how to deal with this more than ever before. London’s population is currently growing 50% quicker than the rest of the UK.

Around the world it is becoming increasingly more common for people to want to move to cities. A report by the UN explained that currently 54% of the world’s population live in urban settings – a number that is expected to rise to 66% by 2050. This, alongside the rise in the global population could mean that by 2050, 2.5 billion people will be living in urban areas. The housing shortage is going to get much worse if we don’t act fast as a city and Nation. We need more affordable flats to buy and more available houses for rent!

Overcrowding in definitely London is definitely a problem – as anyone who has ever taken the tube during rush hour can attest…

Source: http://www.konbini.com/en/lifestyle/overcrowded-underground/

With so many things working against young renters, how do people deal with these rent prices?

There are a multitude of ways people are dealing with the challenging London housing market. Some of the major ‘renting in London’ coping mechanisms include:

Saying goodbye to dreams of living alone

Sharing a flat is the norm. With the cost of a 1-bedroom averaging £1,200, unless you are willing to shell out the majority of your monthly paycheque, get ready to share your living space. The average monthly price for finding a room in a shared flat is between £600 and £1000.

Although you might find a gem of a flat like this one that is only £126 per week and has it’s toilet inside the kitchen…

Source: Vice.com

Accepting that personal space in general is a luxury.

Living in London can mean closet sized bedrooms or sharing a single bathroom with half a dozen people (or more). Many of the larger houses for rent have living rooms converted to bedrooms and sharing rooms is also becoming increasingly common.

Here you can rent this mattress for a mere £430 per month.

Sources: Standard.co.uk

Realising that it’s easier to find a bed to lay in that one to sleep in

With the rise of dating apps like Tinder or Happn, it is easier than ever before to meet a romantic partner. Sadly, the same can not be said for finding low price flats and houses for rent. Many couples solve this problem by moving in together early on in their relationship. The allure of half price rent can be massive in squashing other commitment concerns many people have.

Source: Tinder

Lower your living standards

A recent campaign run by a non-profit that campaigns for improved legislation for young renters in London showed just how bad some people’s living situations are in London. The campaign titled Vent Your Rent showed some very interesting results. For example one renter has to pay 20p every time she showers. Multiple renters complained that their homes were damp or mouldy. Other’s reported flimsy ceilings and structural failings.

#ventyourrent #londonrenting pic.twitter.com/vrJka2UFYo

— Amielia Godfrey (@AmieliaG2) April 29, 2016

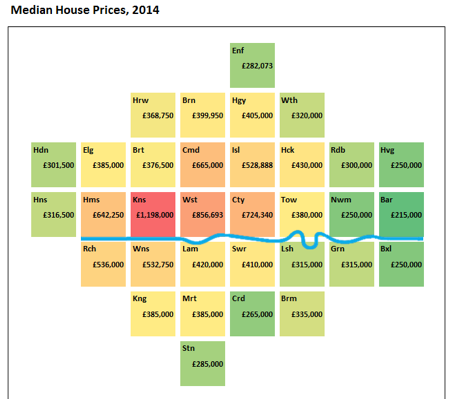

Say goodbye to dreams of buying

The sad truth is that with housing prices in the capital raising faster than ever before, many have to say goodbye to dreams of ever saving up enough to buy a home. The current average price for a home in London is 530k, 3.2x more expensive than the average home price in the mid 90s of 180k. Due to these steep increases in prices, a higher percentage of householders in London are renting than ever before. On the Continent, renting homes later into life has become the norm and it looks like we will soon be going in a similar direction. Buying a house isn’t the only way.

Source:mappinglondon.co.uk/2015/house-prices-a-borough-cartogram/

If I’m a young professional, am I just completely screwed on housing?

While the current situation in London is difficult, there are a lot of people working to make things better. From Sadiq Khan’s new mission as mayor to increase the number of affordable homes in the city, to new emerging housing trends like co-living that are working to create new models for how we live together. Here at acasa HQ we are working everyday to think of new solutions so those sharing some of the many London houses for rent have a much better shared living experience. Other young tech companies, corporations and nonprofit or government organisations are also working to improve life for young renters in London.

Some of our favourite organisations include:

Making Renting Fair campaign led by Vicky Spratt at The Debrief.

Just to name a few of the many organisations helping young renters in London. Please contact us on Twitter if you are part of an organisation that is working for the rights of young renters.